Ethereum is essentially Bitcoin with a gas mechanism added in order to enable it to run a turning complete virtual machine.

In that sense, this gas mechanism was Ethereum’s biggest advancement. There. I said it. It is fairly complex because there are multiple different values to think about. These values are especially confusing when you don’t know their rational. This paper outlines the thought process that logically arrived at it’s design (which is exactly as complex as it needed to be, and no more).

There are 4 variables involved in understanding gas:

- gas-cost

- gas-price

- gas-limit

- block-gas-limit

Design Rational

First let’s understand Bitcoin’s problem and solution, then observe why Ethereum introduces new issues, then see how the gas-based solution solves them.

Bitcoin

Problem: Public blockchains are open networks. Therefore, anyone can DOS attack the whole network by sending millions of transactions at once.

Solution: To mitigate this lets require the transaction sender to attach a fee to the transaction.

Problem: Each block only has limited space. With a fixed fee, a block can still become “full” and there is no more room for more transactions. The rest of the pending transactions will have to wait an arbitrarily long amount of time.

Solution: What we really want is a market, so the user can offer a competitive fee, and the miner will prioritize by highest payment. Users can attach larger fees if they don’t want to wait in line.

Problem: The transaction data unfortunately can vary in size. So even with a fee, someone can still DOS attack the network by sending a couple of huge transactions.

Solution: To solve this, the miner first looks at the tx inputs and outputs, and subtracts them to find its fee, then it divides by the total length of the tx data to prioritize the transaction based on its price-per-byte of data. An attacker now must pay a price roughly proportional to the amount of computation the miner will be performing, and the miner can verify that fact. There is also a limit on the amount of bytes that can be included in a single block, so the miner is interested mostly in maximizing this price-per-byte unit specifically.

Ethereum

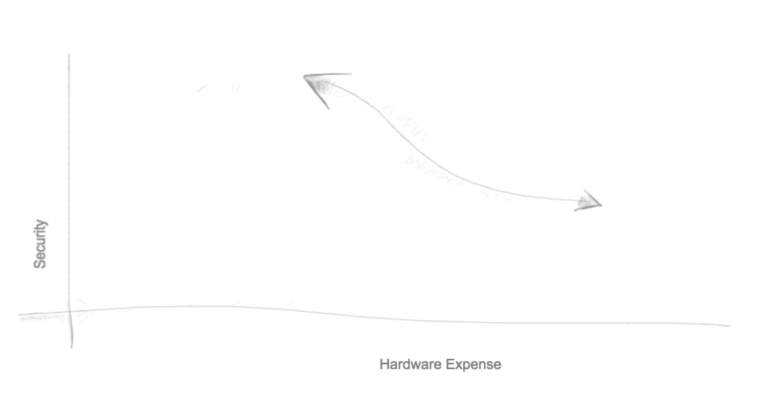

Problem: The scripting language is Turing complete. This means that a transaction script can have jumps and loops. Therefore the amount of computation done on it, is no longer related to the size of the code in bytes. So we can no-longer rely on the price-per-byte metric to be fair payment. An attacker can create a very small piece of code that pays a significant price-per-byte but causes the virtual machine to loop a million times before completing! There is no way for a miner to know this until it actually executes the million loops.

Solution: Enter – Gas. The concept that as the virtual machine executes a program, it tallies how much computation it is doing. Therefore a million loops would “use up” a million times more gas than one loop. Specifically each operation of the virtual machine uses a certain amount of gas whenever it is run: ADD costs 3 gas, MUL costs 5 gas, JUMPI costs 10 gas etc. These values are referred to as gas-cost and are generally static global values defined in a table in the yellow paper.

Instead of specifying a fee amount (as in Bitcoin), the sender specifies a gas-price with his transaction. As the transaction is processed, he will be charged this gas-price for each unit of gas used. This amount goes to the miner. Without both gas-cost and gas-price we can not have a market between miners and senders. We would have the same problem described for bitcoin where a block becomes full and there is nothing to do but wait in line.

And this is about how much people usually know about gas. However we can’t stop there, because there are still issues. let’s see what they are

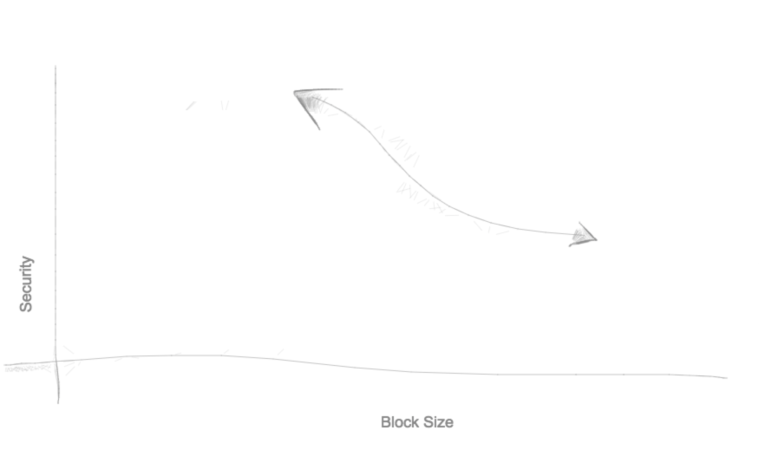

Problem: We also need to have a limit on the amount of computation done per block. This is because blocks need to be able to be processed in a timely manner. Bitcoin had solved this by capping the amount of combined bytes of all the transactions in a block (so-called block-size), but this would not be sufficient in a turing complete environment for the same reasons described above.

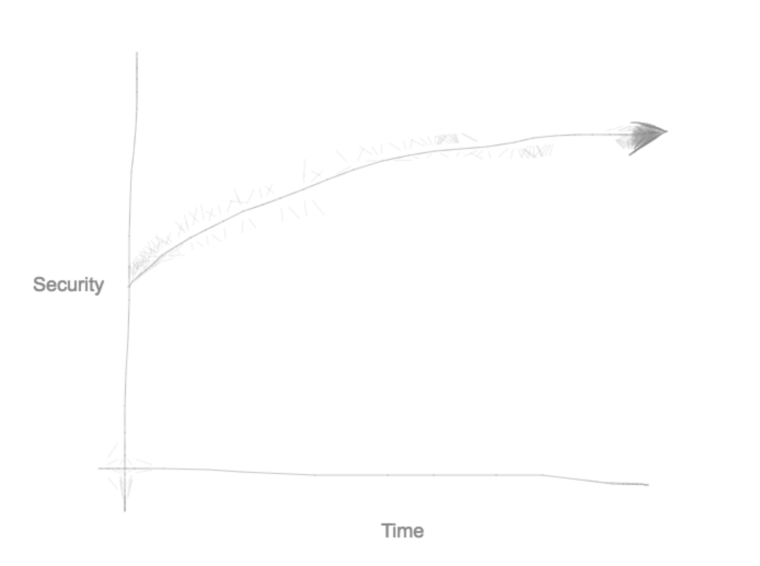

Solution: And for those same reasons, we limit the block computation using gas, and defining another value, the “block-gas-limit”. This is a cap on the cumulative gas used by all the transactions of a single block. This value is not tied to a specific transaction, it is a global value associated with the whole network (as an aside, Ethereum’s block-gas-limit is somewhat dynamic as opposed to Bitcoin’s block-size which is hard-coded).

Problem: We have unfortunately just created another issue. This is the part that people rarely understand. As the miner assembles transactions into a block, the cumulative gas counter will approach the block-gas-limit. As they pick each transaction to include (prioritized by highest gas-price), they will have less room left before reaching the limit. They don’t actually know however, how much gas the next transaction will use until they process it. The sender of the transaction had no fault in this either. Here no one is to blame, but unusable computation was executed.

Solution: Another value is defined by the sender, “gas-limit” (confusingly referred to as simply “gas” from the RPC interface). This value is a hard cap that the transaction sender is willing to use before it should halt. This protects the sender from spending more on the transaction than he expected, however its main purpose is to give the miner an upper bound on the gas that the transaction will consume before processing it. This way, when miner first prioritizes by gas-price, processes transactions one-by-one skipping those whose gas-limit is less then the remaining available space in the current block.

The miner will also check that the sender has enough Ether to pay for the gas-limit that they specified before processing.

If the transaction does reach the gas-limit, everything in the VM is reverted but the payment is still made from the sender to the miner. This is important because the miner could not have known the transaction would halt, and must be compensated for processing it. The sender however can run the transaction locally beforehand and hopefully (based on the contract) ensure it would execute as desired. He must take special care however: Some contracts calls may halt only depending on a state which may be updated by someone else in the meantime because the function is public.

Summary

The sender of the transaction creates it, and decides how much they are willing to pay per unit of computation (gas-price). They also specify an upper bound on how much computation the transaction should do before halting (gas-limit) – which limits their possible cost ether cost as the product of the two. They usually can pre-calculate exactly how much computation is needed, and will send “a little extra”. Only gas that is used, gets charged (so the gas-limit only affects the sender as an upper cap).

The miner must assemble blocks within the block-gas-limit. They maximize profits by prioritizing their mempool by highest gas-price, process those transactions one by one, first checking that each one’s gas-limit is less then the remaining available before the block-gas-limit is reached. Also verifying that the sender has sufficient funds for the gas-limit*gas-price that they themselves specified.

All of this combines to create an ethics system where users and miners are able to participate in a market and where promises are made up front, before work has begun. It may seem complicated, but I hope I’ve proven that it’s exactly what is required (and nothing more) to go from Bitcoin Script, to the more versatile Ethereum Virtual Machine.

Ethereum is simply Bitcoin with a gas mechanism added in order to enable it to run a turning complete virtual machine.

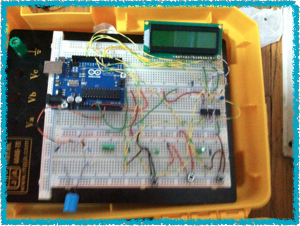

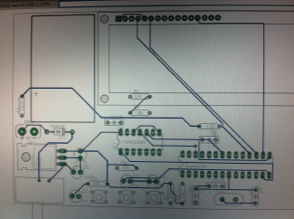

The final product has 3 buttons. One that switches between display modes, one that brings you back to the main display mode (for ultra simple use), and one that, when held down for 1.5 seconds, does rarly used tasks (depending on which display you are on). There is info for a trip A and a trip B. holding down the 3rd button resets whichever trip you are viewing. There is a display mode for acceleration and RPMs, and another for wheel diameter. By holding down button three while viewing wheel diameter, you enter a mode where you can change the diameter. There is one display for Lifetime distance. I’ve gotten the bike up to about 26 miles per hour. The distance tracker seems to agree well with google maps.

The final product has 3 buttons. One that switches between display modes, one that brings you back to the main display mode (for ultra simple use), and one that, when held down for 1.5 seconds, does rarly used tasks (depending on which display you are on). There is info for a trip A and a trip B. holding down the 3rd button resets whichever trip you are viewing. There is a display mode for acceleration and RPMs, and another for wheel diameter. By holding down button three while viewing wheel diameter, you enter a mode where you can change the diameter. There is one display for Lifetime distance. I’ve gotten the bike up to about 26 miles per hour. The distance tracker seems to agree well with google maps.